There was an article in Saturday's paper about the continued increases in individual health insurance premiums across the country, and the expectation that NJ will have a similar increase when Horizon & AmeriHealth (the only two carriers left in NJ for Individual Plans) file their 2018 rates later this month.

As Washington works on health-insurance reform, it continues to be evident that change is required. The current AHCA bill definitely has its own flaws, but something needs to be done soon to stabilize the individual market - these annual rate increases are just not sustainable.

Healthy individuals will find it more and more difficult to pay health insurance premiums versus just paying the individual mandate penalty and rolling the dice with no insurance. This places additional strain on the individual market, because the folks that are left needing insurance have to pay higher and higher premiums to offset the high claims cost... it's a death spiral of costs.

The ACA currently has an individual mandate penalty which is intended to pressure healthy people to buy insurance so they can avoid the mandate penalty. The AHCA is proposing to remove the individual mandate penalty, and create a 30% premium penalty in the future when the individual decides to sign-up for individual health insurance, after not having continuous coverage. The net goal is similar - trying to keep everyone (healthy & unhealthy) covered on health insurance and paying premiums to offset the overall claims costs.

Unfortunately, both the Individual Mandate Penalty and the Continuous Coverage proposal will not fix the overall costs problem. The main driver behind these insurance increases is the astronomical increases on backend healthcare costs - Hospitals, Prescription Drugs, and other costs are just out of control.

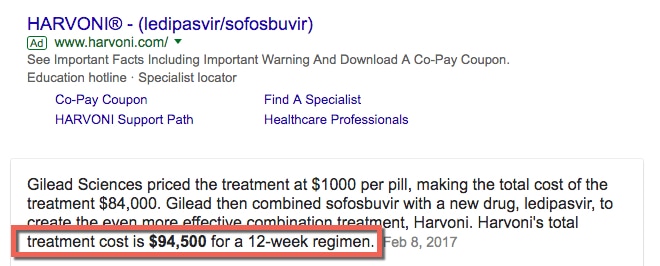

Next time you are watching television and you see an ad for Prescription Drug, you should google "retail cost of drug-name". A couple popular ad's we see a lot of these days are for Harvoni and Humira.

As Washington works on health-insurance reform, it continues to be evident that change is required. The current AHCA bill definitely has its own flaws, but something needs to be done soon to stabilize the individual market - these annual rate increases are just not sustainable.

Healthy individuals will find it more and more difficult to pay health insurance premiums versus just paying the individual mandate penalty and rolling the dice with no insurance. This places additional strain on the individual market, because the folks that are left needing insurance have to pay higher and higher premiums to offset the high claims cost... it's a death spiral of costs.

The ACA currently has an individual mandate penalty which is intended to pressure healthy people to buy insurance so they can avoid the mandate penalty. The AHCA is proposing to remove the individual mandate penalty, and create a 30% premium penalty in the future when the individual decides to sign-up for individual health insurance, after not having continuous coverage. The net goal is similar - trying to keep everyone (healthy & unhealthy) covered on health insurance and paying premiums to offset the overall claims costs.

Unfortunately, both the Individual Mandate Penalty and the Continuous Coverage proposal will not fix the overall costs problem. The main driver behind these insurance increases is the astronomical increases on backend healthcare costs - Hospitals, Prescription Drugs, and other costs are just out of control.

Next time you are watching television and you see an ad for Prescription Drug, you should google "retail cost of drug-name". A couple popular ad's we see a lot of these days are for Harvoni and Humira.

Most people don't realize that the retail cost of an 8-week treatment of HARVONI is $90,000+. Google "retail cost of Harvoni"

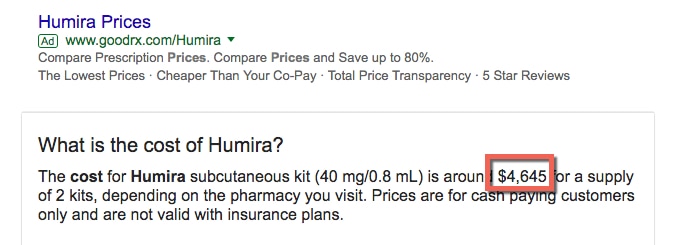

Another popular commercial we see frequently is for HUMIRA.

Most people don't realize that a month supply of Humira is over $4,000. Also Humira generally treates chronic conditions (like Chrone's disease), which means this is a drug that you could take for years/lifetime. Google "retail cost of Humira".

These are just two brief examples. Next time you are watching TV and see a commercial for a prescription drug - google the retail the price... you will be shocked what you find!

If you have a gold or platinum-level plan with first dollar coverage, you may have no idea the actual costs of the services or drugs you are consuming since the insurance company is paying these bills.

If you have a high-deductible plan, you may have some concept of these costs, but only until you meet the deductible on your plan... then, the insurance company is paying these bills.

When the actuaries at the insurance companies look to create their premiums for the upcoming year, the claims costs are the main driver for the continued increases in premiums. We can fiddle with individual mandates and continuous coverage requirements (which are still important for stability), but until we address these backend issues - don't expect a reduction in premium increases.

I look forward to Washington finding solutions to address these types of out-of-control backend health care costs, which is the only way we will get overall healthcare spending under control.

RSS Feed

RSS Feed